child tax credit september 2021

This third batch of advance monthly payments totaling about 15 billion is reaching about 35. Increases the tax credit amount.

News Columbia University Center On Poverty And Social Policy

The credit amount was increased for 2021.

. It doesnt matter if they were born on January 1 at 1201 am. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The 2021 CTC is different than before in 6 key ways.

Even if you dont owe taxes you could get the full CTC refund. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Makes the credit fully refundable.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim. Updated September 15 2021 253 PM ORDER REPRINT Eligible families are set to receive a third round of monthly child tax credit direct payments this week. Ad Discover trends and view interactive analysis of child care and early education in the US.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. The only caveat to this is if you and your childs other parent dont live.

We need this money. The remaining 2021 child tax credit payments will be. IR-2021-188 September 15 2021.

IR-2021-188 September 15 2021. Parents report problems receiving September child tax credit Published Fri Sep 17 2021 318 PM EDT Updated Fri Sep 17 2021 729 PM EDT Alicia Adamczyk AliciaAdamczyk. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for.

Or December 31 at 1159 pm if your child was born in the US. 31 rows The current tax season has been as bumpy as the last with many tax filers reporting delayed. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. The IRS is paying 3600 total per child to parents of children up to five years of age. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021.

By making the Child Tax Credit fully refundable low- income households will be. Missing your September child tax credit payment. The IRS sent out the third child tax credit payments on Wednesday Sept.

That means parents. Child Tax Credit 2022. The IRS states that a qualifying child for the purposes of the 2021 child tax credit is an individual who does not turn 18 before January 1 2022.

Thats an increase from. Removes the minimum income requirement. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

That drops to 3000 for each child ages six through 17. Millions of families across the US will be receiving their third advance child tax credit payment next week on. That child must also meet other conditions.

Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. Congress fails to renew the advance Child Tax Credit. The credit was made fully refundable.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days to a week later. The advance is 50 of your child tax credit with the rest claimed on next years return.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. The 2021 advance monthly child tax credit payments started automatically in July.

Child Tax Credit 2022. Get the up-to-date data and facts from USAFacts a nonpartisan source. Parents of about 60 million children will receive direct deposit payments on September 15 while some may receive the checks through the mail anywhere from a few days to a week later.

This year the child tax credit was increased from up to 2000 per qualifying child to up to 3600 for children ages 5 and younger at the end of.

Tax Credits And Coronavirus Low Incomes Tax Reform Group

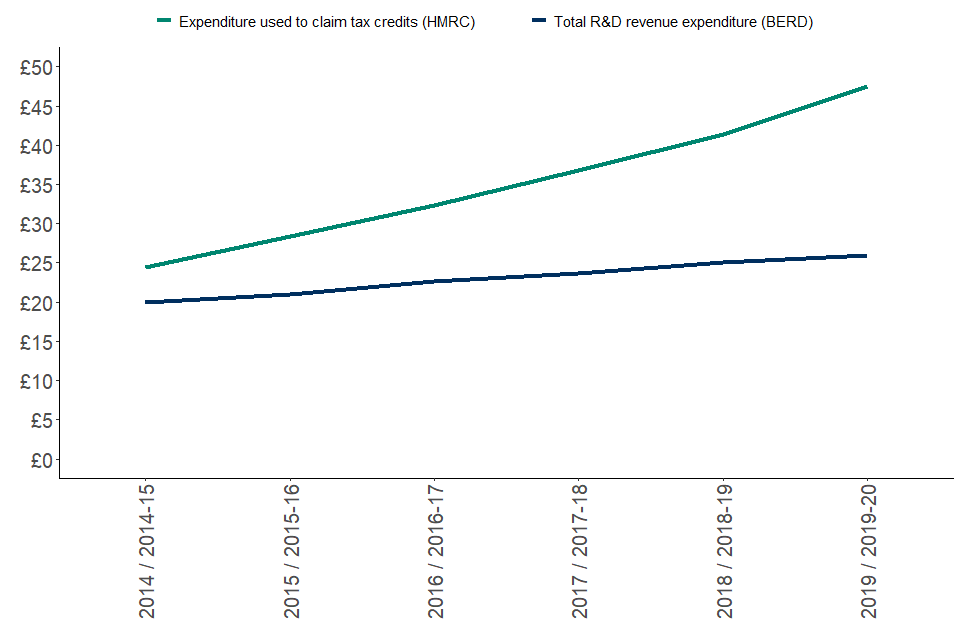

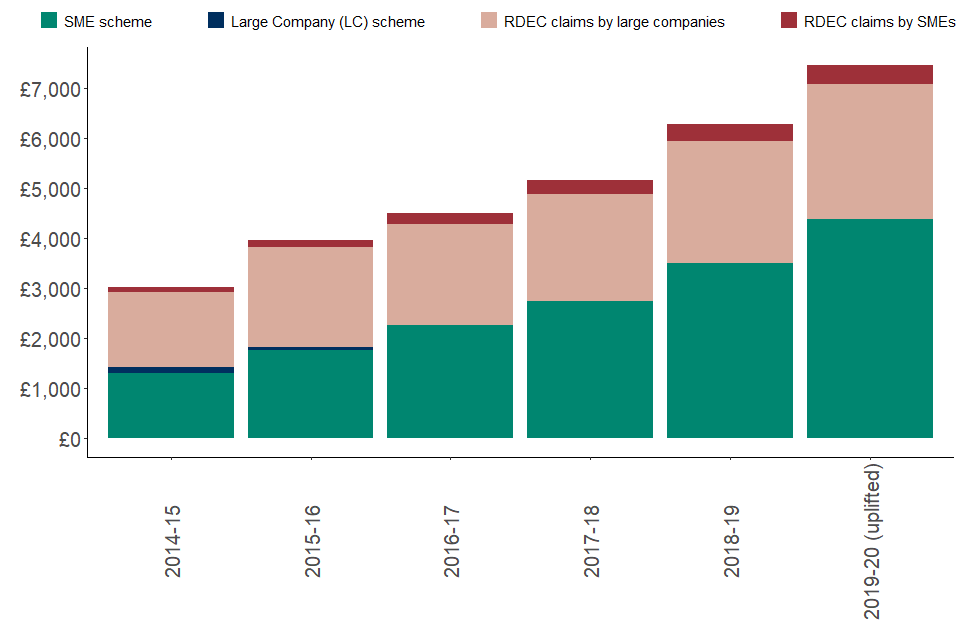

Research And Development Tax Credits Statistics September 2021 Gov Uk

Child Tax Credit 2021 8 Things You Need To Know District Capital

Research And Development Tax Credits Statistics September 2021 Gov Uk

Expiration Of Child Tax Credits Hits Home Pbs Newshour

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

What Families Need To Know About The Ctc In 2022 Clasp

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Reasons To Invest Deutsche Telekom

Reasons To Invest Deutsche Telekom

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Credits Payment Dates 2022 Easter Christmas New Year

Child Tax Credit 2021 8 Things You Need To Know District Capital